30 June 2025

SEPA Instant roll-out update 30-06-2025

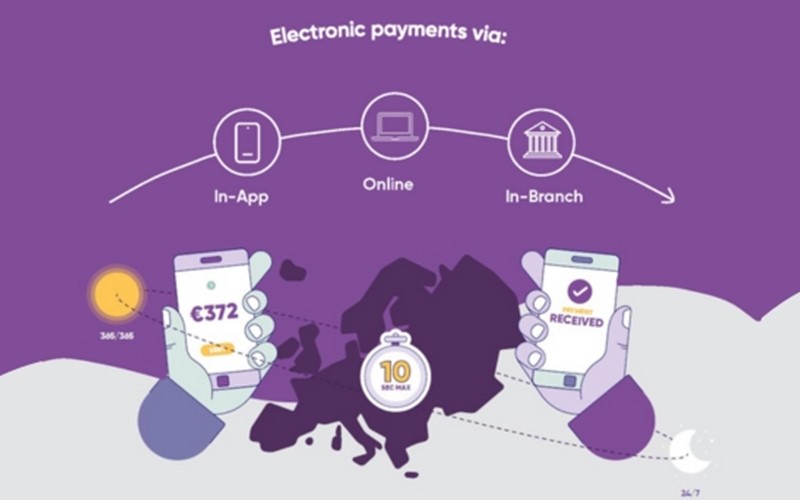

- Instant Euro Transfers: Real-time payments across participating European banks, credit unions and other payment service providers.

- Always Available: No more waiting - payments available anytime, even outside business hours*.

- Simple Access: Use your existing online banking or mobile app. Just choose "Instant Transfer" when sending funds. Or you can ask for an Instant Transfer when transacting in branch.

- Anti-Fraud Services: With limited ability to recall a payment in this new instant payment environment, we are introducing additional Fraud and Misdirected Payment checks.

1. A Verification of Payee (VOP) service will start from 9 October 2025. This will check whether the account name you enter when setting up a payment matches the name on the recipient’s (person you are sending to) bank account. This extra layer of security helps ensure that your money is going to the right person or business

2. An anti-fraud monitoring service will also be introduced to look for anomalies and unusual patterns of behaviour on your account. This extra layer of security is an additional safeguard should your account details be compromised.

What do I need to do?

- We are making changes to the framework contract that applies to your account in relation to SEPA Instant in line with Regulation 76 of the Payment Services Regulations. This can be viewed here and a copy can be obtained in branch on request.

If you are happy to accept the changes, you do not need to take any action.

If you do not want to accept the changes, you have the option, free of charge, to close your account, clearing anything you owe on it first, or let us know you are ending your agreement with us. You can do this by writing to your local branch.

If we don't hear from you before 31 August 2025, we'll apply these changes.

- Check out further information on the roll out of SEPA Instant, including the limitations of this service, and the introduction of Anti-Fraud services here.

- To prevent a misdirected payment, we advise you to review the payees saved on your account and delete any that are no longer needed.

- To safeguard your account from fraud, follow the latest Fraud Awareness guidelines. FraudSmart.ie is a great resource for tips on how to protect yourself.

OUR TOP TIP: Stop, pause and think. Be wary when being asked to transfer funds with an immediate need, especially if it's to a new payee.

If you have any questions, please e-mail us at info@affinitycu.ie.

Thank you for being a valued member of Affinity Credit Union.