04 November 2025

Savings Cap Update 04-11-2025

Affinity Credit Union is pleased to announce changes to the savings cap.

With immediate effect:

- The amount each member can hold in Affinity Credit Union has been increased to €100,000.

There is currently no monthly lodgement cap in place.

-

We understand that savings are important to provide independence, peace of mind and the strength to withstand unexpected emergencies. This increases aims to help facilitate persons wishing to build savings whether it be for holidays, mortgage deposits, rainy day funds, etc..

Frequently Asked Questions:

Yes. Affinity Credit Union is a financially strong and stable credit union and member’s savings continue to be guaranteed by the Government Deposit Guarantee Scheme.

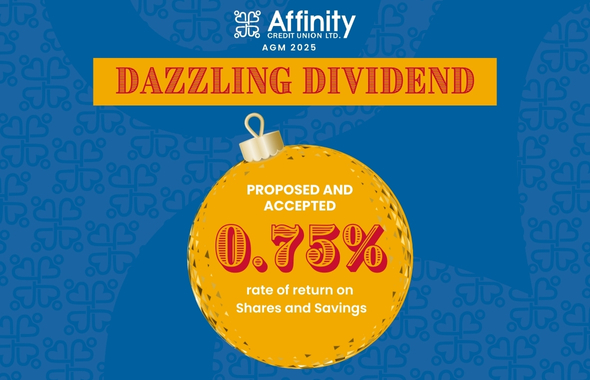

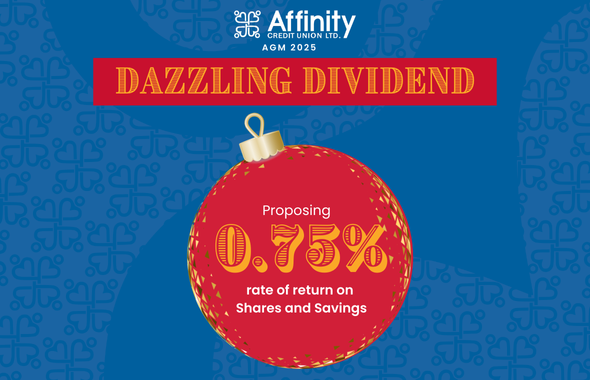

The shares and deposits you hold with Affinity Credit Union Limited for the year are eligible for dividend and interest returns. The rate of return is agreed at the Annual General Meeting at year end and is paid out of surplus income.

Past performance is not a reliable guide to future returns.

There are no hidden fees or charges on savings accounts with Affinity Credit Union.

...

There will be a fee of €5 incurred if a direct debit is returned unpaid, i.e. there was insufficient funds to meet this payment. This is a fee the bank charges the Credit Union, and we must pass that fee on. We alert all members to this when first setting up a Direct Debit. If a Direct Debit is returned unpaid 3 times, we will cancel this so the member does no incur any further fees.

Yes. Your Shares account is your main savings account, however you can open sub accounts, e.g. Savings 1 or Savings 2 to save separately.

...

These sub accounts are handy if you have a loan with us, as the funds in your Shares account will be held as collateral against the loan, but you can continue to save into a sub account and have access to these funds anytime.

...

You can also use sub-accounts for specific savings goals. For example you could have a 'Savings 1' for Christmas expenses, a 'Savings 2' for Mortgage deposit savings.

...

Ask any of our staff members if you want to open a separate savings account

Yes! You can view balances, make lodgements, transfer between your accounts or to external bank accounts, and view and download statements. Register for online access here. Already have a PIN? Login here or download our App.

...

If you would prefer not to view your savings balance online, you can open an Offline Savings sub-account. Remove the temptation for impulsive withdrawals and reach your savings goal sooner.

Find out more on Offline Savings here.